Introduction

In our extensive coverage of Chainlink and the intrinsic value of the network’s native LINK token, we touched on how prohibitively expensive the service is and the narrow addressable market its architecture implies.

In this article, we will take a deeper look into why the leading DeFi lending protocols (which inarguably are Chainlink’s most suitable use cases as of today) diverge away from Chainlink.

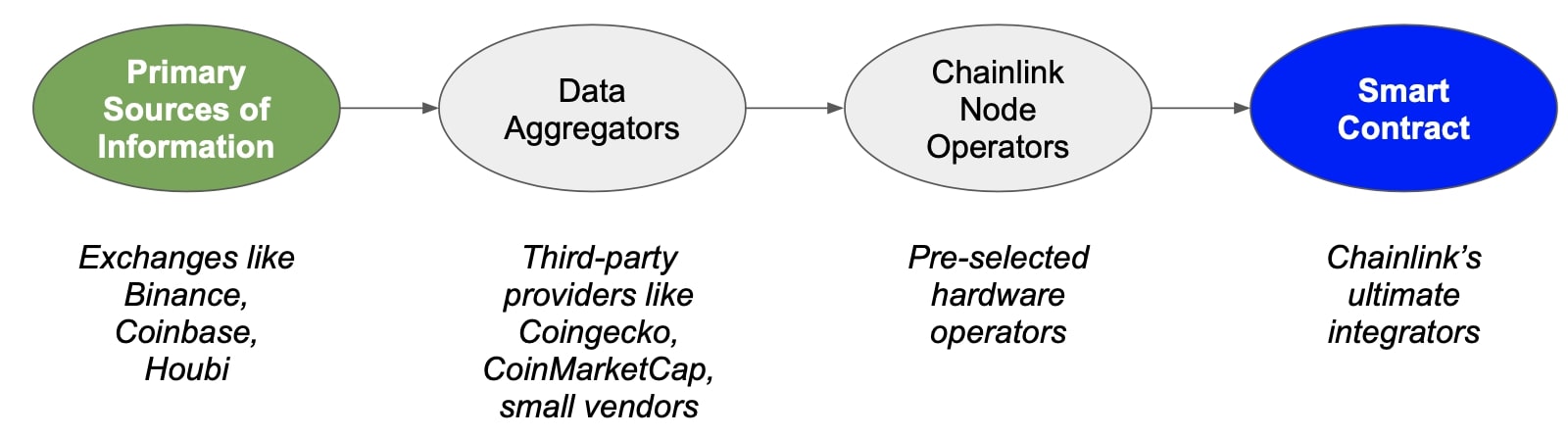

First, let’s recall how Chainlink works:

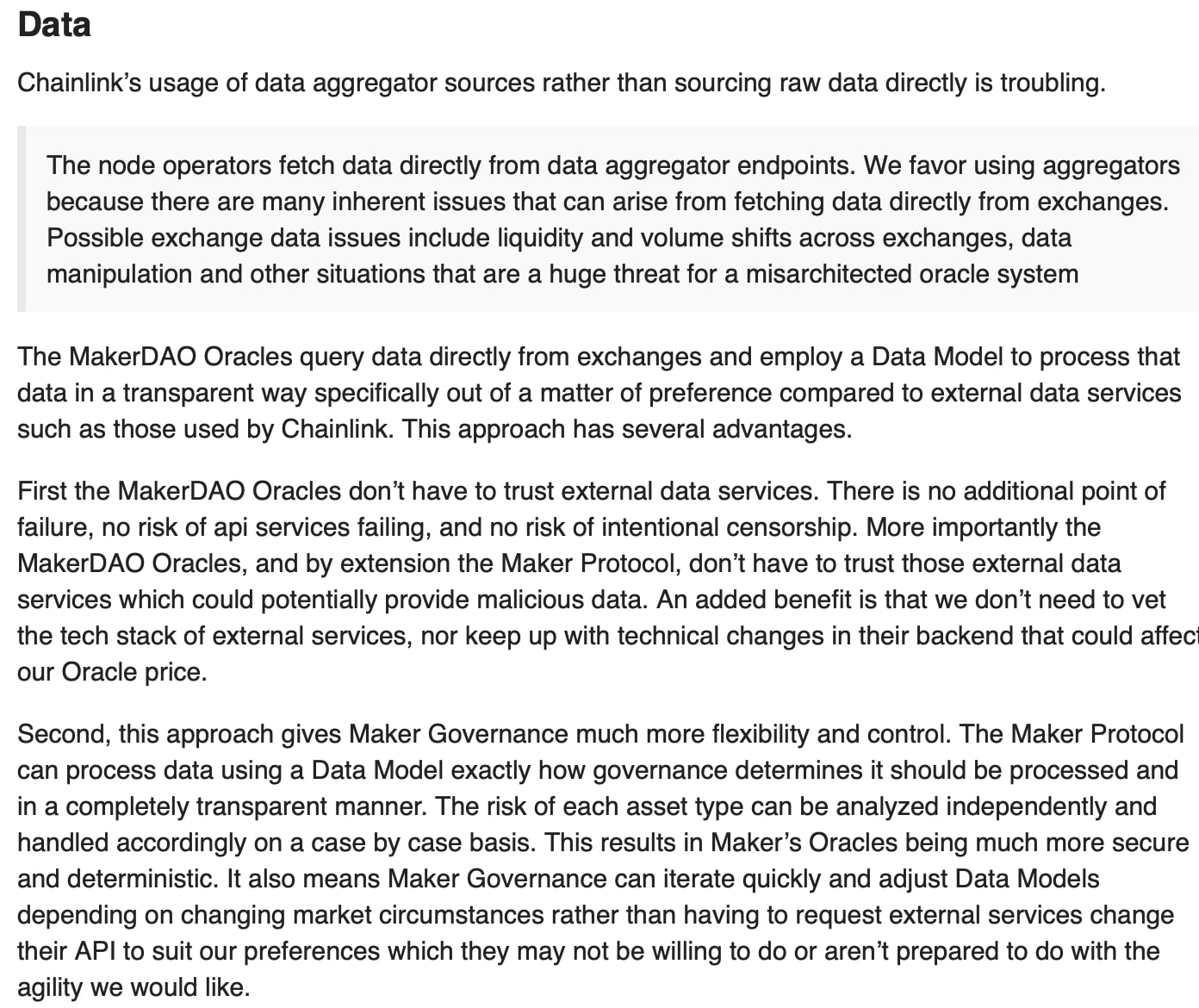

Chainlink takes pride in retrieving data from aggregators rather than primary sources. They argue that by relying on (yet another) middleman specialized in data collection, cleaning, and weightings, Chainlink can focus on the development of its core features and transfer the data quality assurance to a third party. This approach is inherently flawed and comes with numerous drawbacks:

- Each additional layer of intermediaries adds latency to the data, rendering Chainlink useless for high-frequency data applications (think of DEXes);

- The aggregators are black boxes over which neither Chainlink nor the integrator has any power or visibility. Chainlink acts as a gatekeeper by performing "extensive security checks" on each node operator before onboarding. This approach goes against the fundamental principles of the blockchain technology, gradually turning Chainlink into a highly centralized ecosystem, which by design is under the full control of SmartContract;

- Furthermore, the aggregators, all of which pull data from the same primary sources, represent a new pressure point open for exploitation by bad actors, compared to an algorithm directly connected to the data generators. Albeit, the current architecture results in slower and more expensive data delivery;

- Chainlink is not a blockchain. It is simply a software running between a level 1/2 infrastructure and external APIs, which makes the network highly dependent on the costs of the underlying blockchain and its potential shortfalls. The Chainlink community is arguing that the approach makes the service blockchain agnostic while lowering the hardware requirements for node operators. In reality, this creates layers and layers of unnecessary intermediaries each adding new complexities into the system. To put it into perspective, a Chainlink integrator running on Ethereum must own ETH (to trigger the log event) and LINK (to pay for the data request) to receive a simple HTTP request.

We are not the first to reach the conclusion that Chainlink’s is not a commercially viable solution.

MakerDAO

Digesting Chainlink’s latest fiasco with MakerDAO confirmed our conviction, as industry insiders and oracle experts are bringing Chainlink’s shortfalls we have pointed out. The public discussions also shed some light on Chainlink’s user acquisition strategy, and key selling points and techniques they are using.

What exactly happened? First, an official Chainlink representative (Johann Eid) posted a formal proposal, window-dressing Chainlink’s shortcomings as advantages and discretely mentioned that if integrated, MakerDAO will take full advantage of Chainlink’s loyal army. The response was muted so the heavy artillery was summoned.

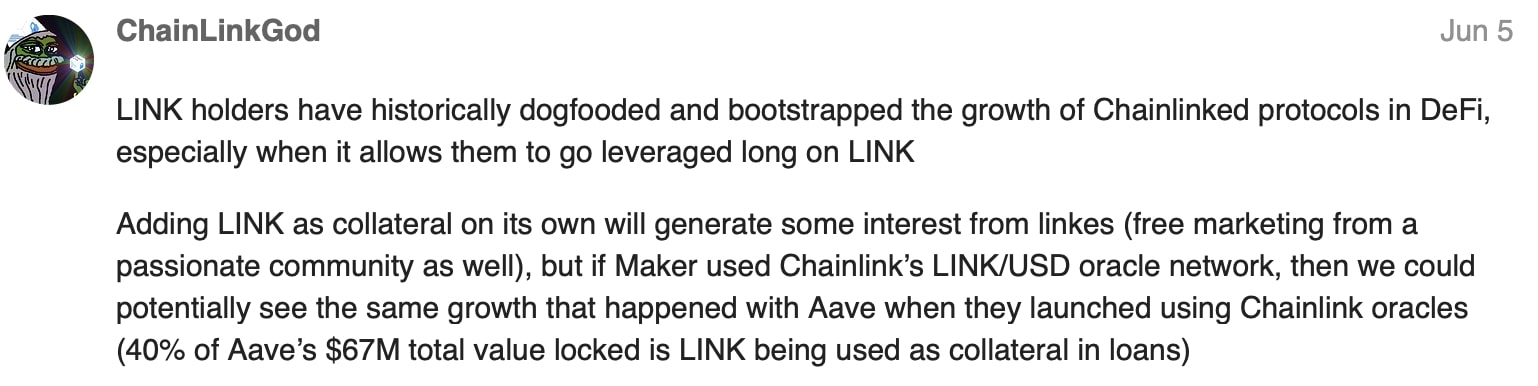

The ringleader arrived and started heavily selling Chainlink’s only real asset - the community, taking full pride in the exponential growth Aave experienced following the integration with Chainlink.

Once again, the Maker community was reluctant to cheer the proposal so ChainLinkGod had to try harder, and came up with a 6,000-word essay. We find his efforts entertaining, giving a textbook example of how an actual FUD should be executed. First, he posed as a true friend of MakerDAO, a "user of DAI" himself, who advised the project to focus on its core proposition while leaving their oracle initiative behind. Otherwise, he warned, MakerDAO risks losing market share to competitors. Then, he went into great detail of the "superiority" of Chainlink’s "technology", and the "experienced" team they assembled.

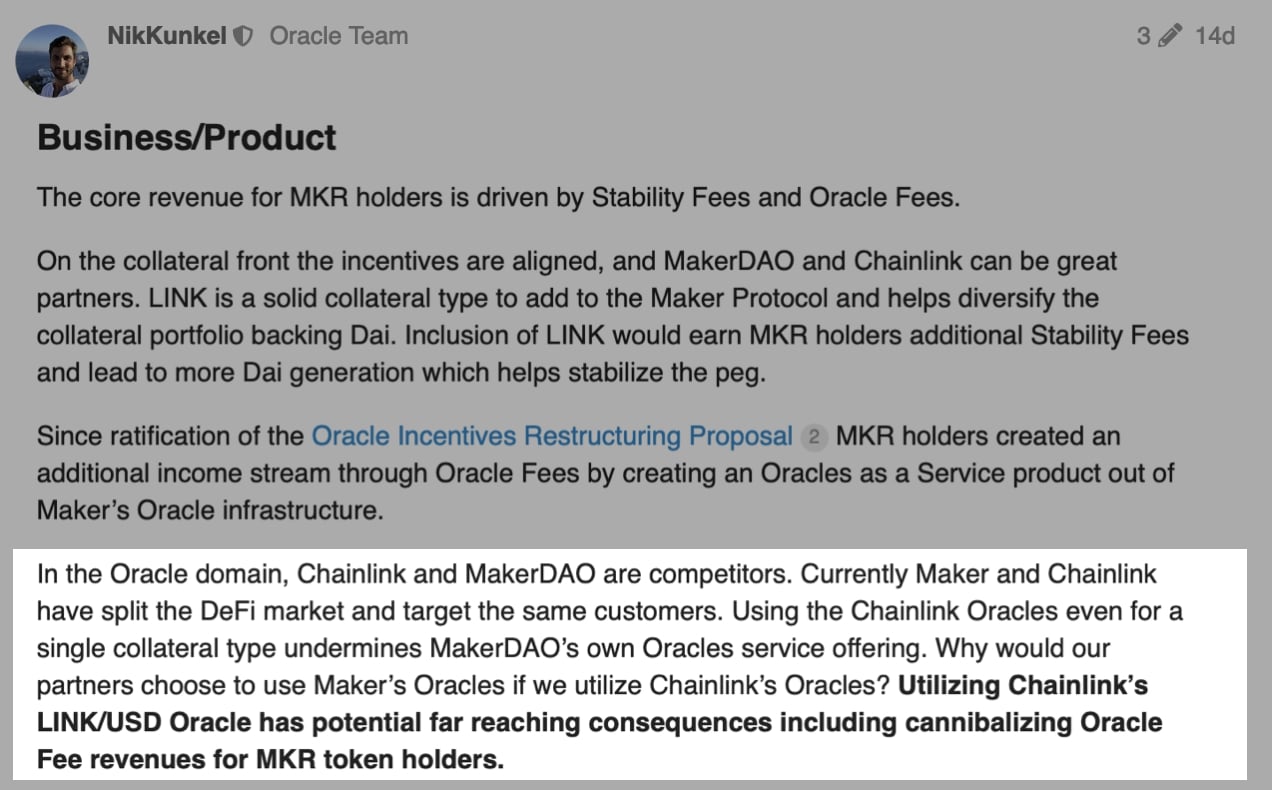

Finally, Nik Kunkel from MakerDAO’s oracle team arrived and pointed out what Chainlink actually is:

In defense of Chainlink, Johann said that the address mentioned by Kunkel is a multisig contract with eight independent signers. Now, how independent the signers might be if all of them are preselected by SmartContract?

Chainlink is trying to dismiss MakerDAO’s Oracle initiative, as a non-core business within their operations. This is the same as saying Amazon should abandon AWS because their core business is selling stuff online, and let Google or Microsoft take care of the cloud. MakerDAO’s Oracles is not a separate business line, but a reinforcement of the project’s core proposition. As such, Maker can better utilize its oracles and have a competitive advantage over pure play competitors like Chainlink. The same way Amazon can cross-utilize their hardware and provide cloud services better and cheaper than me and you.

With regards to the quality of the data, we cannot state it clearer compared to Nik’s explanation:

As we stressed in our original report, MakerDAO is not a potential client but a rival with a clear competitive advantage against Chainlink. And Maker is not alone.

Compound

The Compound protocol previously relied on a price feed, maintained by their team, to determine each user’s borrowing capacity and to measure liquidation thresholds. Compound recognized that such a solution presents a potential single point of failure and went on to develop the Open Price Feed (OPF).

OPF is designed as a permissionless, upgradable price feed for the Compound protocol which can operate perpetually without reliance on any one project and allows any developer to reliably access on-chain prices.

The Open Price Feed allows a data provider (Reporters) to sign price data using a known public key, which any Ethereum address (Posters) can submit on-chain. Coinbase Pro is the first functioning Reporter using the Open Price Feed format for all assets traded on their platform.

How does it work?

Coinbase reliably signs price data, every few minutes. Upon posting, the prices are checked against a 30-60 minute time-weighted average price using the assets/ETH pair on Uniswap v2. To be accepted, the Reported price must fall within 20% of the reference price on Uniswap. The long 30 minutes time frame makes Uniswap price manipulation attacks prohibitively expensive.

Why Compound is not using Chainlink?

Price feeds are a critical risk for most DeFi projects that rely on price data to enforce the rules of the protocol, including Compound. Chainlink would like to position themselves as the highly secure industry standard for such use cases, so why are Compound not using them and developed an in-house solution instead?

Robert Leshner, the founder of Compound explained: "Alternative solutions like Chainlink present their own risks; technical risks (whether or not their contracts have been audited), centralization risks (who can edit/replace the contracts, e.g. a centralized company), etc."

Conclusion

None of the large DeFi projects is willing to integrate Chainlink. We already showed that most of Chainlink "integrations" are either grossly exaggerated or plain fake. If no respectable blockchain organization finds use of Chainlink, what is the chance of a player outside the crypto ecosystem picking Chainlink as a service provider?

Close to zero.

We maintain our short position in LINK.

Other news:

Chainlink fears competition so much... and they should

The Aftermath of the "Liquidate Zeus" Campaign

What Determines the LINK Price: A Crash Course on Economics

What Stands Behind Chainlink’s Actual Integrations?

Exposing The Chainlink's Ponzi Scheme - The Army of Paid LINK Marines

Industry Insider Exposes Chainlink’s "Partnership-as-a-Marketing" Scheme

Exposing Chainlink's Pump & Dump Scheme